Accounting codes

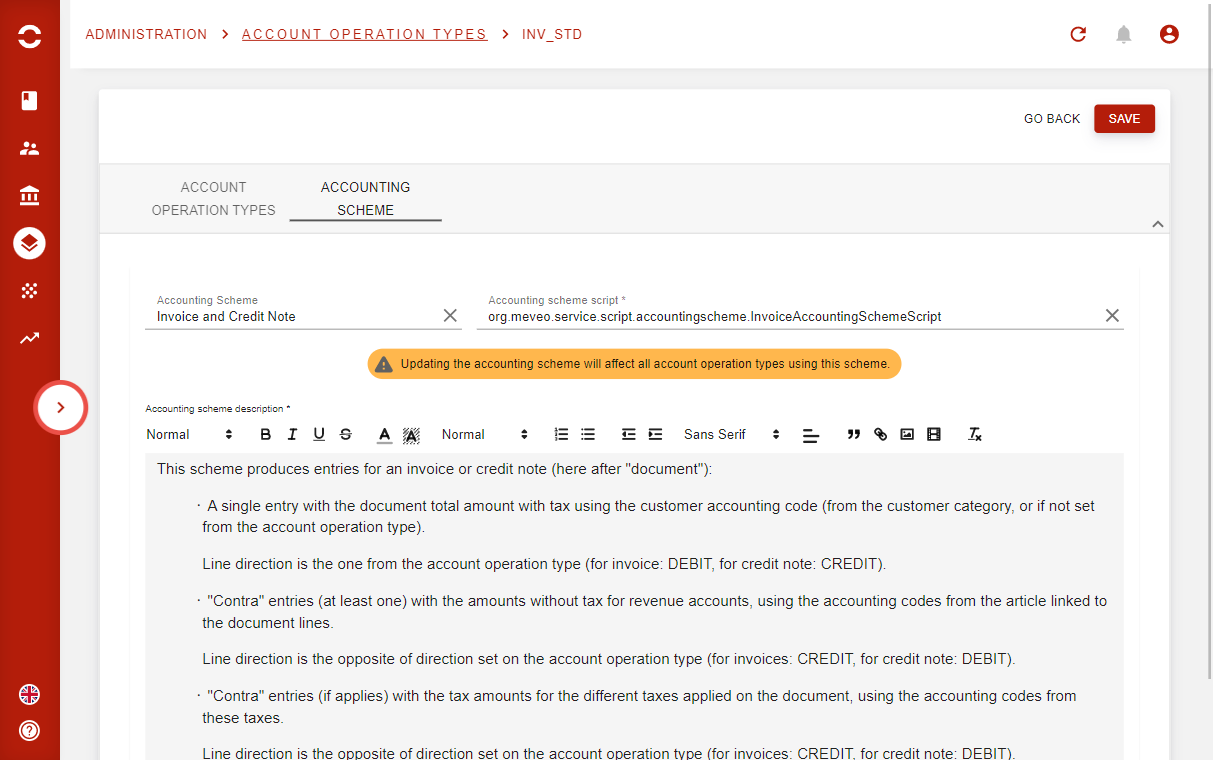

Accounting scheme is what tells how an account operation will be accounted for; to which accounting account will go the different elements of the operation.

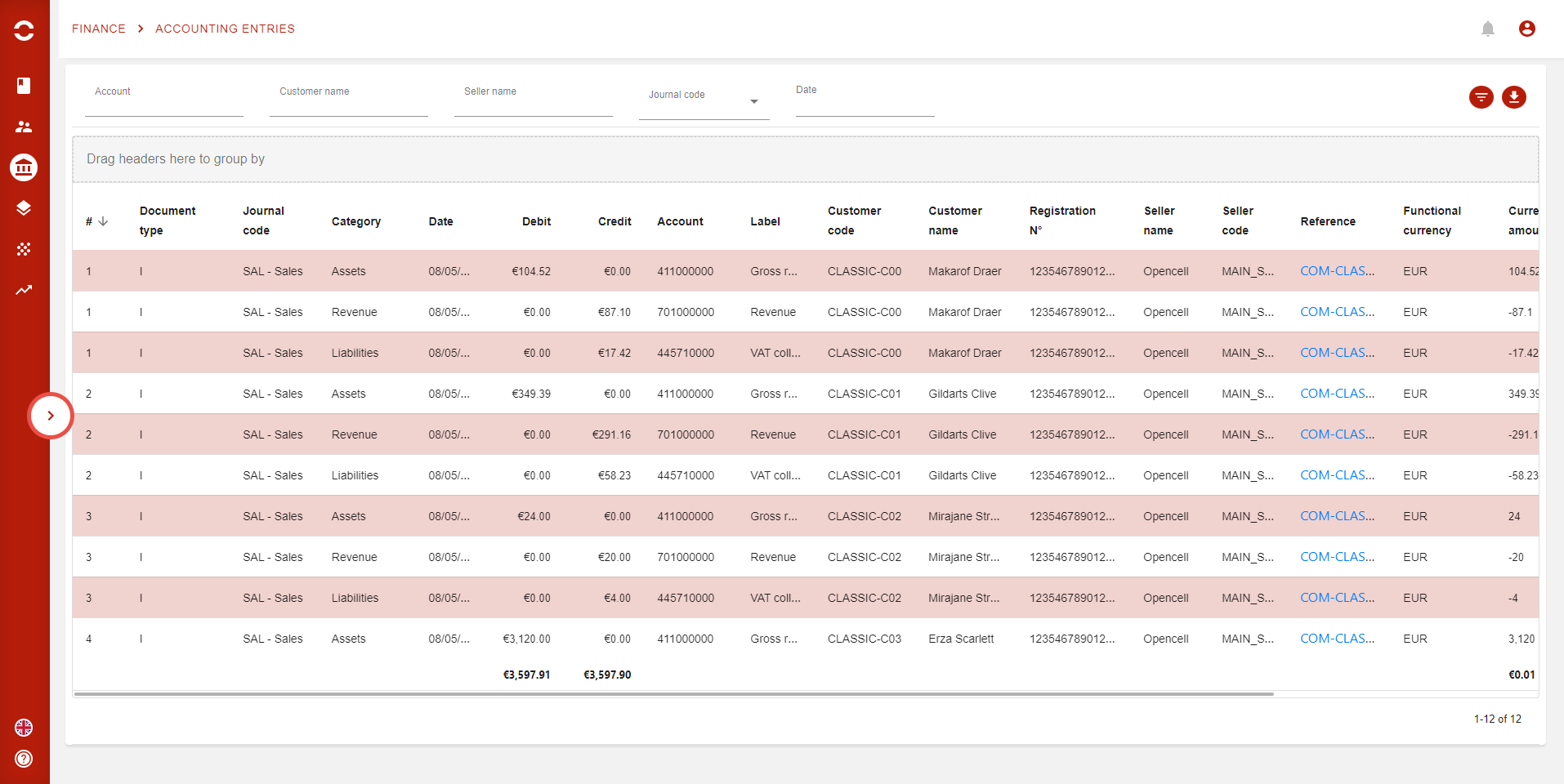

The result is a set of accounting journal entries.

Typically for an invoice, we will have in the “sales” journal:

Total amount with tax will go to an entry linked to a client accounting account

Amounts without tax for each Invoices line will go to entries linked to revenue accounts

Tax amounts will go to tax accounts

This logic is described by accounting schemes.

Opencell provides default accounting schemes for invoices, adjustments, payments, and miscellaneous operations.

Of course, you will be able to customize them and add new ones to match the way your business manages its accounting.

Accounting codes

Accounting scheme for invoices

Downloadable accounting entries report

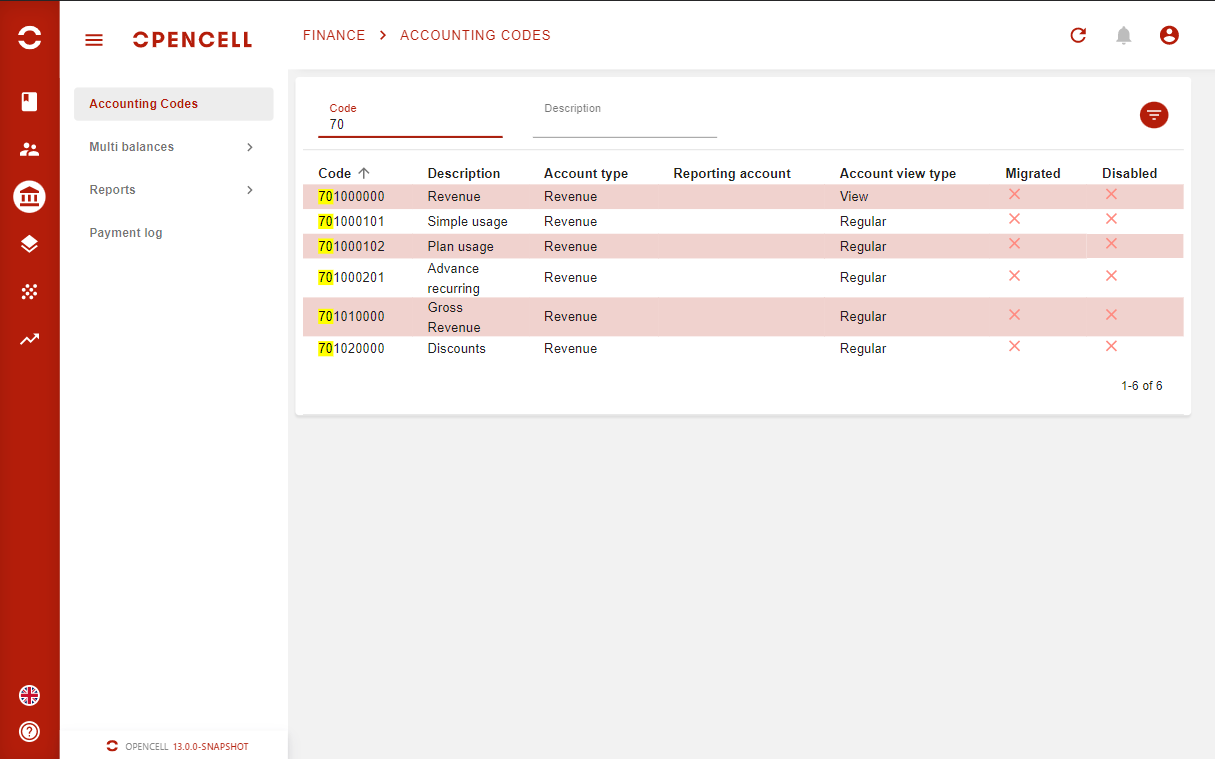

Opencell now allows you to manage accounting codes based on your company’s internal rules, as well as on the financial rules your company is legally bind to.

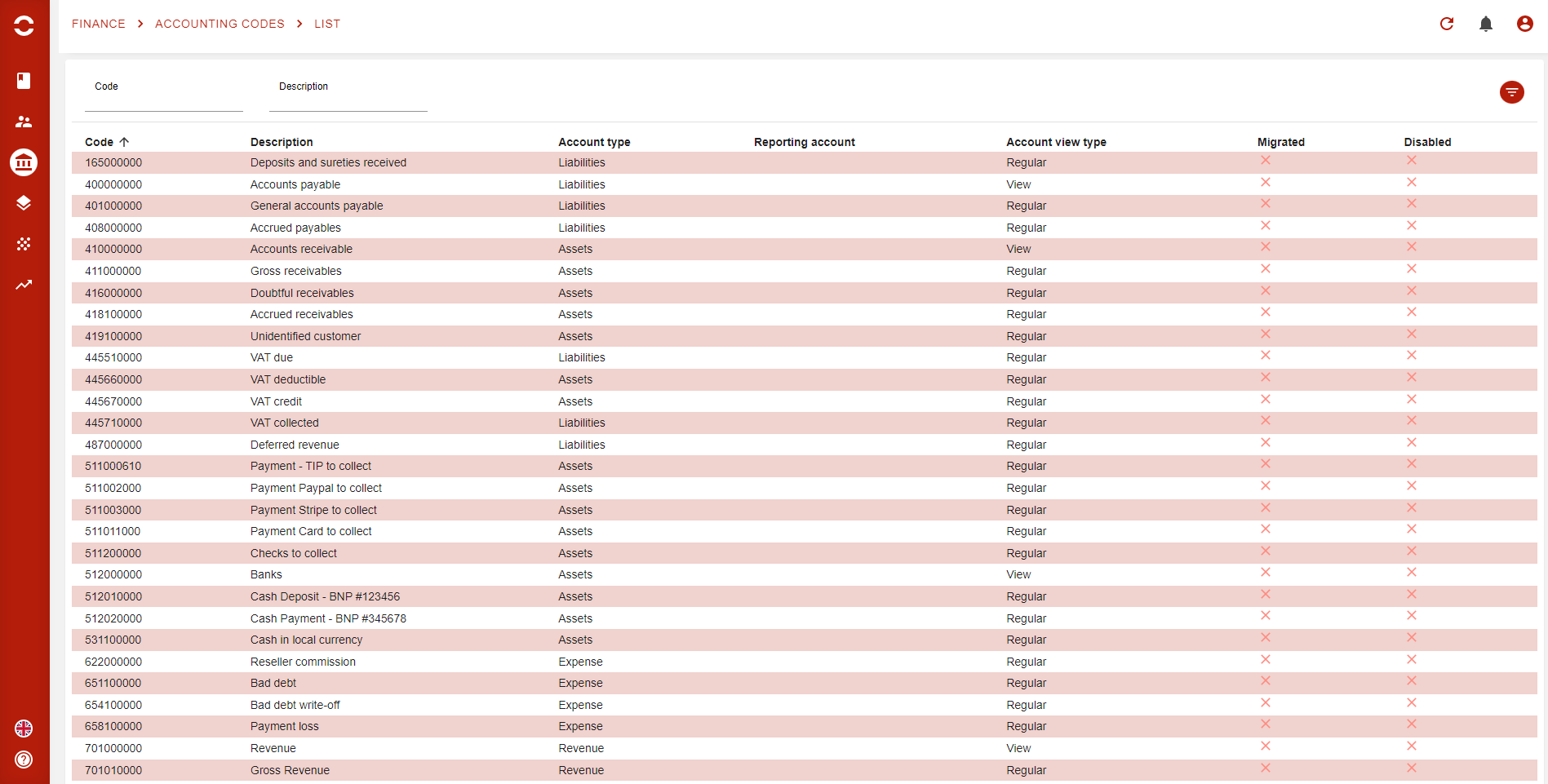

To access the whole list of accounting codes, go to the Finance app → Accounting codes. You will then arrive on the following page:

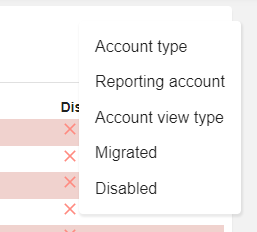

Once there, you will be able to use the search bars at the top left corner of the list, or, to go further, you are able to use the :filter: button: